The Great Wealth Transfer

Mundra Residential Group August 14, 2024

Mundra Residential Group August 14, 2024

In recent years, there has been a significant shift in how wealth is distributed among generations.

In recent years, there has been a significant shift in how wealth is distributed among generations. It is called the Great Wealth Transfer.

Historically, the transfer of wealth from one generation to the next was a more gradual process, often limited to smaller amounts of inheritance or family savings. But today, the scale has increased in a big way. As a recent article from Bankrate says:

The biggest wave of wealth in history is about to pass from Baby Boomers over the next 20 years, and it’s going to have major impacts on many facets of life. Called The Great Wealth Transfer, $84 trillion is poised to move from older Americans to Gen X and millennials. If it has managed smartly, Americans will be able to grow their wealth and ensure their financial security.

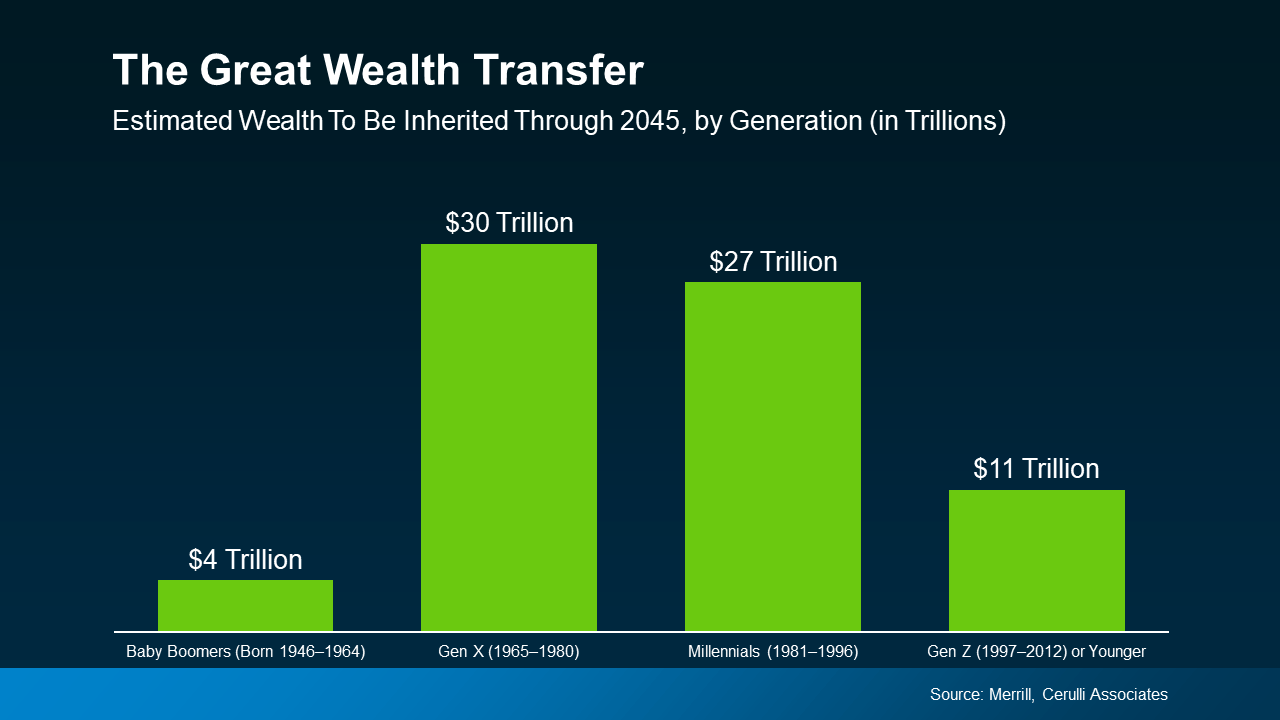

Basically, as more Baby Boomers retire, sell businesses, or downsize their homes, more substantial assets are being passed down to younger generations. And this creates a powerful ripple effect that'll continue over the next few decades. The graph below uses data from Merrill and Cerulli Associates to give you an idea of how much inherited money is set to change hands through 2045:

Impact on the Housing Market

Impact on the Housing MarketOne of the most immediate effects of this wealth transfer is on the housing market. Home affordability has been a concern for many aspiring buyers, especially in high-demand areas. The increase in generational wealth is expected to ease some of these challenges by providing future homeowners with greater financial resources. As assets are passed down through generations, buyers may find themselves in a better position to afford homes. Merrill talks about that benefit in a recent article:

While millennials face steep barriers . . . to buying a first home in many markets, that hass a for-now story, not a forever story . . . The Great Wealth Transfer should enable more of them to become homeowners, or trade up or add a second home, either through inherited property or the funds for a down payment.

But the Great Wealth Transfer doesn't just impact housing. It is also going to provide a new avenue for entrepreneurial spirits to fuel economic growth. If someone is looking to start a business and they are receiving funds like this, that money can used as the necessary capital to start a new company. This helps the next generation of innovators and business owners bring their ideas to life.

While affordability remains a challenge in today's housing market, the ongoing Great Wealth Transfer is poised to unlock new opportunities. As wealth is passed down and put to use, it’s expected to ease some of the barriers to homeownership and fuel other entrepreneurial endeavors.

Affordability Economy Wed, 14 Aug 2024 10:30:00 +0000

Over the past couple of years, a lot of people have had a hard time buying a home.

Over the past couple of years, a lot of people have had a hard time buying a home. And while affordability is still tight, there are signs it's getting a little better and might keep improving throughout the rest of the year. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

Housing affordability is improving ever so modestly, but it is moving in the right direction.

Here is a look at the latest data on the three biggest factors affecting home affordability: mortgage rates, home prices, and wages.

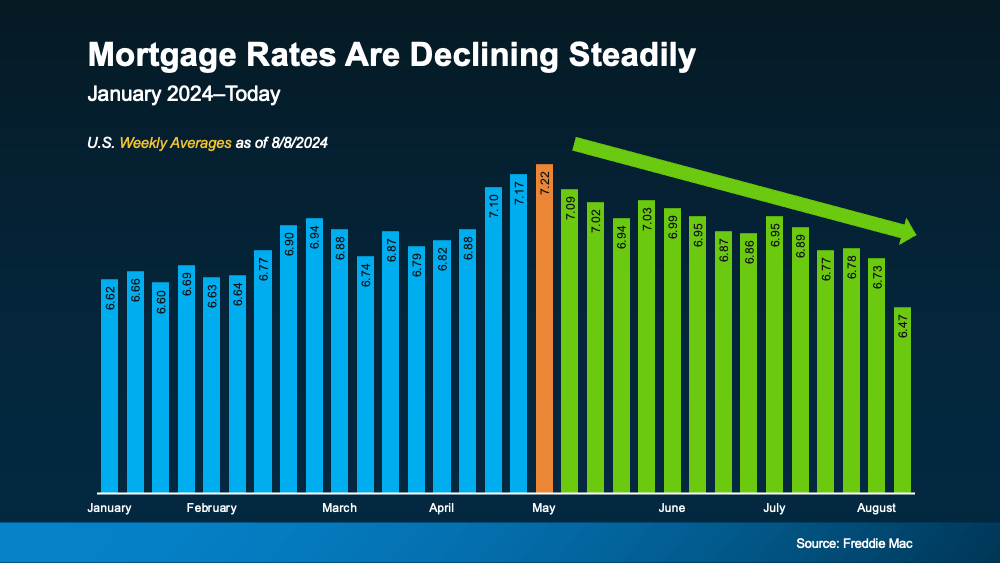

Mortgage rates have been volatile this year, bouncing around from the mid-6% to low 7% range. But there's some good news. Data from Freddie Mac shows rates have been trending down overall since May (see graph below):

Mortgage rates have improved lately in part because of recent economic, employment, and inflation data. Moving forward, some rate volatility is to be expected. But if future economic data continues to show signs of cooling, experts say mortgage rates could keep going down.

Mortgage rates have improved lately in part because of recent economic, employment, and inflation data. Moving forward, some rate volatility is to be expected. But if future economic data continues to show signs of cooling, experts say mortgage rates could keep going down.

Even a small drop can help you out. When rates decline, it's easier to afford the home you want because your monthly payment will be lower. Just don't expect them to go back down to 3%.

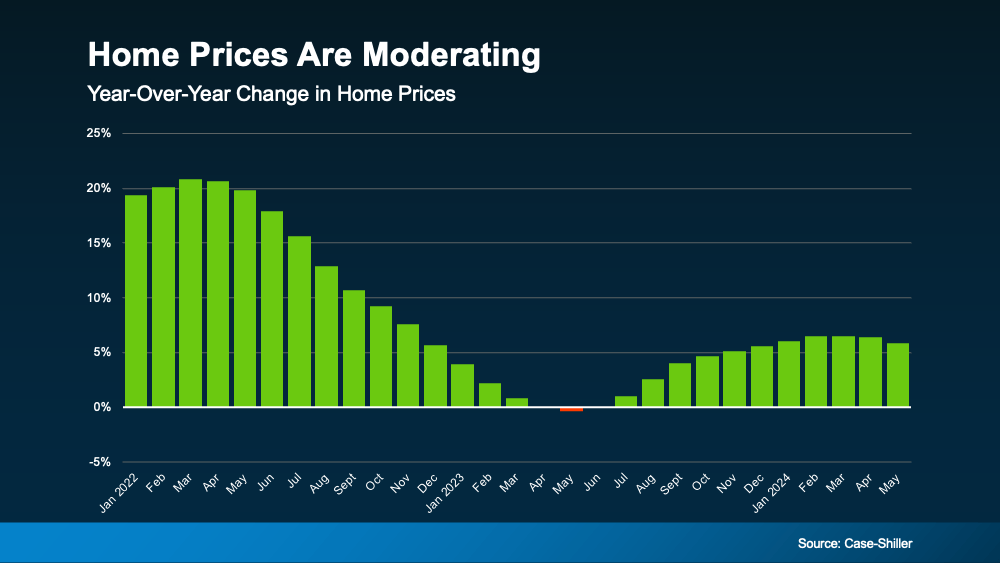

The second big thing to think about is home prices. Nationally, they are still going up this year, but not as fast as they did a couple of years ago. The graph below uses home price data from Case-Shiller to illustrate that point:

If you're thinking about buying a home, slower price growth is good news. Home prices went up a lot during the pandemic, making it hard for many people to buy. Now, with prices rising more slowly, buying a home may feel less out of reach. As Odeta Kushi, Deputy Chief Economist at First American, says:

If you're thinking about buying a home, slower price growth is good news. Home prices went up a lot during the pandemic, making it hard for many people to buy. Now, with prices rising more slowly, buying a home may feel less out of reach. As Odeta Kushi, Deputy Chief Economist at First American, says:

While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help“ so the dream of homeownership isn't boarded up just yet.

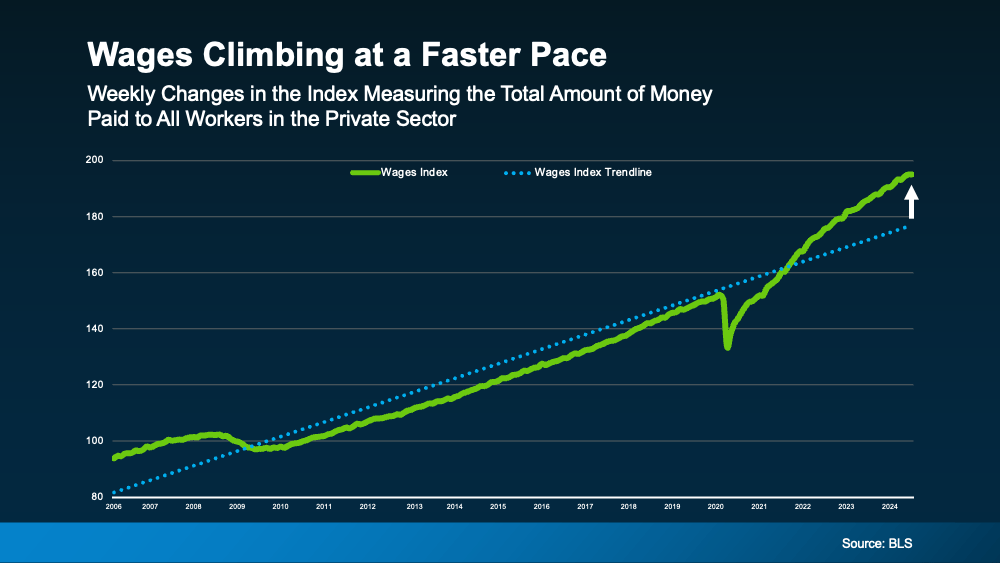

Another factor helping with affordability is rising wages. The graph below uses data from the Bureau of Labor Statistics (BLS) to show how wages have increased over time:

Look at the blue dotted line. It shows how wages usually go up in a typical year. On the right side of the graph, you'll see wages are rising even faster than normal right now that's the green line.

Look at the blue dotted line. It shows how wages usually go up in a typical year. On the right side of the graph, you'll see wages are rising even faster than normal right now that's the green line.

This helps you because if your income increases, it's easier to afford a home. That is because you won't have to spend as much of your paycheck on your monthly mortgage payment.

When you put all these factors together, you see mortgage rates are trending down, home prices are rising more slowly, and wages are going up faster than usual. Though affordability is still a challenge, these trends are early signs things might be starting to improve.

For Buyers Home Prices Mortgage Rates Affordability Economy Tue, 13 Aug 2024 10:30:00 +0000

One of the biggest bright spots in today's housing market is how much the supply of homes for sale has grown since the beginning of this year.

One of the biggest bright spots in today's housing market is how much the supply of homes for sale has grown since the beginning of this year.

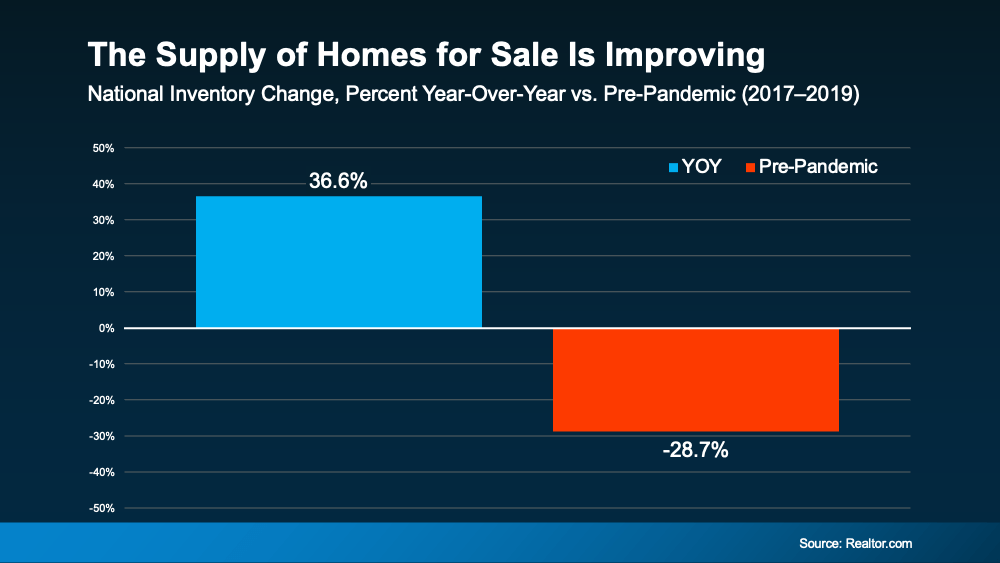

Recent data from Realtor.com shows that nationally, there are 36.6% more homes actively for sale now compared to the same time last year. That's a significant improvement. It gives you far more options for your move than you would have had just a year ago. And with supply improving, you're also regaining a bit of negotiation power. So, if you are someone who thought about buying a home over the last few years but was discouraged by how limited inventory was, this should be welcome news.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.

But just so you have perspective, even though inventory has grown, that doesn't mean we've suddenly flipped to an oversupply of homes on the market. There are nowhere near enough homes for sale to make prices crash. If you compare today's inventory levels to more normal, pre-pandemic numbers (2017 - 2019), there are still roughly 29% fewer homes actively for sale now (see graph below):

So, while we are up by almost 37% year-over-year, we are still not back to how much inventory there'd be in a normal market.

So, while we are up by almost 37% year-over-year, we are still not back to how much inventory there'd be in a normal market.

As Bill McBride, Housing Analyst for Calculated Risk, explains:

. . . currently inventory is increasing year-over-year but is still well below pre-pandemic levels.

But that's okay. It is to be expected. As a country, it'll take a while to get back to the typical level of homes for sale. And the good news for buyers is, in some select markets, it is closer to being a reality.

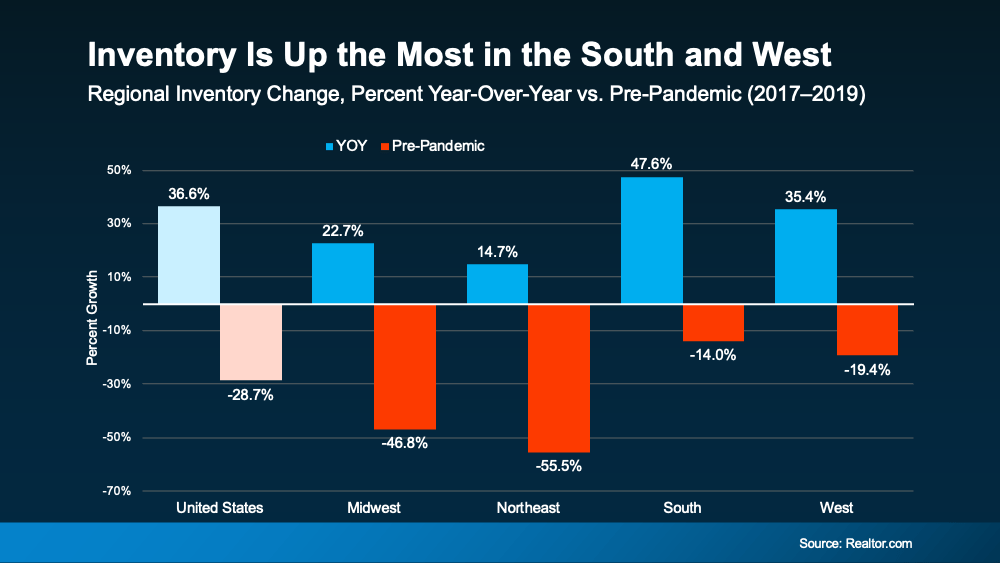

Here is a rundown of what today's inventory growth looks like by region (see graph below):

Real estate will always be hyper-local. If you want to find out what inventory numbers look like where you live, reach out to a local agent. They’ll be able to tell you what they’re seeing and how it stacks up to the national market. You may find you have even more opportunity to move where you are.

Real estate will always be hyper-local. If you want to find out what inventory numbers look like where you live, reach out to a local agent. They’ll be able to tell you what they’re seeing and how it stacks up to the national market. You may find you have even more opportunity to move where you are.

The supply of homes across the country is improving in a big way. As a buyer, that gives you more options for your home search, and ultimately, a better chance of finding what you like.

So, what are you looking for in a home? And what's your budget? Reach out to a local agent to go over that together to find the options that may be right for you.

For Buyers Inventory Mon, 12 Aug 2024 10:30:00 +0000

If you're thinking about selling your house, it is important to know what the home inspection is and what inspectors look for.

For Sellers Infographics Selling Tips Fri, 09 Aug 2024 10:30:00 +0000

If you are planning to sell your house and move, you probably know there's been a shortage of options available.

If you are planning to sell your house and move, you probably know there's been a shortage of options available. But here's the good news: the supply of homes for sale has grown in a lot of markets this year and that's not just existing, or previously-owned, homes. It's true for newly built homes too.

So how do you decide which route to go? Do you buy an existing home or a brand-new one? The choice is yours you just need to figure out what is most important to you.

Here are some benefits of buying a newly built home right now:

In today's market, a lot of builders are focusing on selling their current inventory before they add more homes to their mix. And some of them are offering concessions and are more willing to negotiate to make a sale happen.

That, coupled with the fact builders are primarily building smaller, more affordable homes, has led to one other potential perk. The median price for a newly built home in today's market is actually lower than the median price of an existing home – which isn’t usually the case. Ralph McLaughlin, Senior Economist at Realtor.com, shares:

Homebuyers who are looking for that ‘new-home smell’ may be in a relatively friendlier market than times past when new homes were considerably more expensive than used ones.

If you are interested in seeing what builders nearby have to offer, lean on your real estate agent. Their knowledge of local builders, new communities, and builder contracts will be important in this process.

Now, let's compare that to the benefits of buying an existing home.

In addition to these lifestyle benefits, there is strategic value to buying an existing home, too. Remember, you can always make upgrades to an existing home down the road to give it some of the latest features available. This gives you the best of both worlds: you’ll get the charm, the neighborhood, and over time, you can still add those on-trend elements you may see in a brand-new home. And if you do, you’ll likely increase the home’s value too. An article from LendingTree explains:

. . . they can personalize it and possibly increase its potential resale value with cosmetic upgrades . . . Plus, if a home comes with physical details or stories that add charm, in some cases, these elements are attractive enough to add to a home's resale value . . .

Want to see what is available? Your real estate agent can show you what homes are for sale in your area, so you can see if there is one that works for you and your needs.

There are a lot of factors that go into deciding whether to buy an existing home or a newly built one after you sell, but it’s essential in today's market to understand the opportunities you can find in both. Work with a local housing market professional so you have expert guidance as you explore the options in your area.

For Buyers For Sellers New Construction Affordability Thu, 08 Aug 2024 10:30:00 +0000

Mortgage rates have been one of the hottest topics in the housing market lately because of their impact on affordability.

Mortgage rates have been one of the hottest topics in the housing market lately because of their impact on affordability. And if you are someone who is looking to make a move, you have probably been waiting eagerly for rates to come down for that very reason. Well, if the past few weeks are any indication, you may be getting your wish.

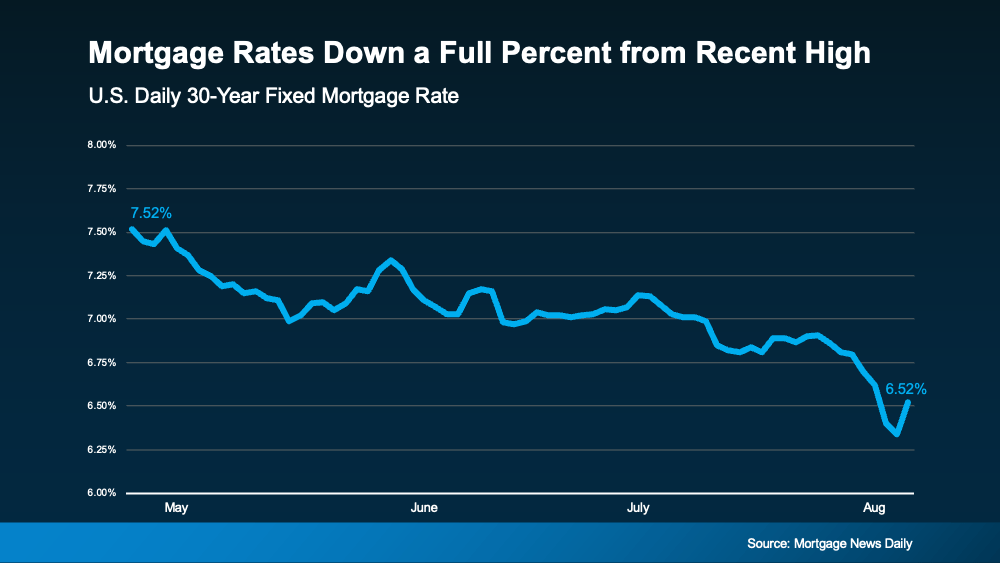

There’s big news for mortgage rates. After the latest reports on the economy, inflation, the unemployment rate, and the Federal Reserve’s recent comments, mortgage rates started dropping a bit. And according to Freddie Mac, they are now at a level we haven’t seen since February. To help show the downward trend, check out the graph below:

Maybe you are seeing this and wondering if you should ride the wave and see how low they’ll go. If that is the case, here’s some important perspective. Remember, the record-low rates from the pandemic are a thing of the past. If you’re holding out hope to see a 3% mortgage rate again, you’re waiting for something experts agree won’t happen. As Greg McBride, Chief Financial Analyst at Bankrate, says:

Maybe you are seeing this and wondering if you should ride the wave and see how low they’ll go. If that is the case, here’s some important perspective. Remember, the record-low rates from the pandemic are a thing of the past. If you’re holding out hope to see a 3% mortgage rate again, you’re waiting for something experts agree won’t happen. As Greg McBride, Chief Financial Analyst at Bankrate, says:

The hopes for lower interest rates need the reality check that 'lower' doesn't mean we're going back to 3% mortgage rates. . . the best we may be able to hope for over the next year is 5.5 to 6%.

And with the decrease in recent weeks, you’ve got a big opportunity in front of you right now. It may be enough for you to want to jump back in.

If you wait for mortgage rates to drop further, you might find yourself dealing with more competition as other buyers re-ignite their home searches too.

In the housing market, there’s generally a relationship between mortgage rates and buyer demand. Typically, the higher rates are, the lower buyer demand is. But when rates start to come down, things change. Buyers who were on the fence over higher rates will resume their searches. Here is what that means for you. As a recent article from Bankrate says:

If you're ready to buy, now might be the time to strike. Home prices have been rising primarily because of a longstanding shortage of homes for sale. That's unlikely to change, and if mortgage rates do fall below 6%, it’s possible buyers would enter the market en masse, further pushing up prices and resurrecting bidding wars.

If you've been waiting to make your move, the recent downward trend in mortgage rates may be enough to get you off the sidelines. Rates have hit their lowest point in months, and that gives you the opportunity to jump back in before all the other buyers do too.

If you are ready and able to start the process, reach out to a local real estate professional to get started.

For Buyers Mortgage Rates Affordability Economy Wed, 07 Aug 2024 10:30:00 +0000

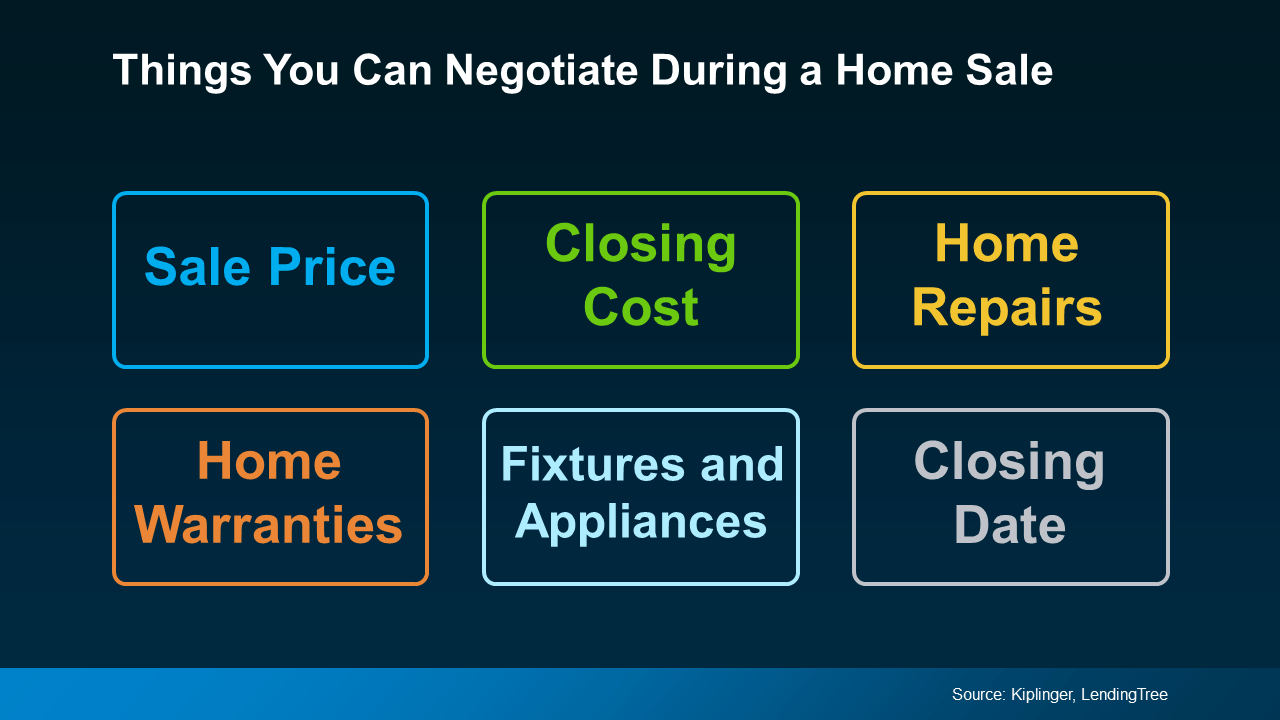

If you haven't already heard, homebuyers are regaining some negotiating power in today's market.

If you haven't already heard, homebuyers are regaining some negotiating power in today's market. And while that doesnt make this a buyer's market, it does mean buyers may be able to ask for a little more. So, sellers need to be ready for that possibility and know what they are willing to negotiate.

Whether you are looking to buy or sell a house, here is a quick rundown of potential negotiations that may pop up during your transaction. That way, you are prepared no matter which side of the deal you are on.

Most things in a home purchase are on the negotiation table. Here is a list of just a few of those options, according to Kiplinger and LendingTree:

One thing is true whether you are a buyer or a seller, and that is how much your agent can help you throughout the process. Your agent is your go-to for any back-and-forth. They'll handle the conversations and advocate for your best interests along the way. As Bankrate says:

Agents have expert negotiating skills. Without one, you must negotiate the terms of the contract on your own.

They may also be able to uncover what the buyer or seller is looking for in their discussions with the other agent. And that insight can be really valuable at the negotiation table.

Buyers are regaining a bit of negotiation power in today's market. Buyers, knowing what levers you can pull will help you feel confident and empowered going into your purchase. Sellers, having a heads up of what they may ask for gives you the chance to think through what you'll be willing to offer.

Want to chat more about what to expect and the options you have? Connect with a local real estate agent.

For Sellers Agent Value Selling Tips Tue, 06 Aug 2024 10:30:00 +0000

Curious about selling your home?

Curious about selling your home? Understanding how much equity you have is the first step to unlocking what you can afford when you move. And since home prices rose so much over the past few years, most people have much more equity than they may realize.

Here is a deeper look at what you need to know if you are ready to cash in on your investment and put your equity toward your next home.

Home equity is the difference between how much your house is worth and how much you still owe on your mortgage. For example, if your house is worth $400,000 and you only owe $200,000 on your mortgage, your equity would be $200,000.

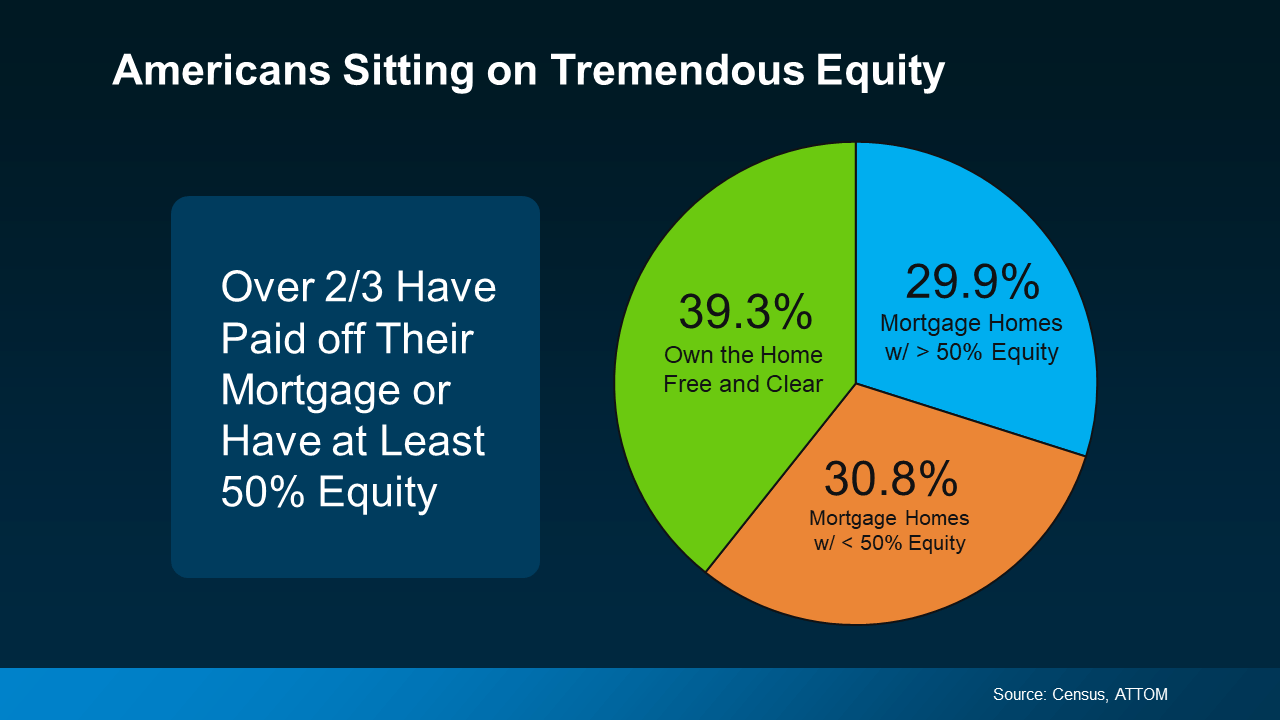

Recent data from the Census and ATTOM shows Americans have significant equity right now. In fact, more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity in their homes (shown in blue in the chart below):

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

If you're thinking about selling your house, it is important to know how much equity you have, as well as what that means for your home sale and your potential earnings. The best way to get a clear picture is to work with your agent, while also talking to a tax professional or financial advisor. A team of experts can help you understand your specific situation and guide you forward.

Home prices have gone up, which means your equity probably has too. Connect with a local real estate agent so you can find out how much equity you have in your home and move forward confidently when you sell.

For Sellers Equity Selling Tips Mon, 05 Aug 2024 10:30:00 +0000

Back in 2008, there was an oversupply of homes for sale.

Foreclosures Infographics Inventory Fri, 02 Aug 2024 10:30:00 +0000

Are you a part of the Sandwich Generation?

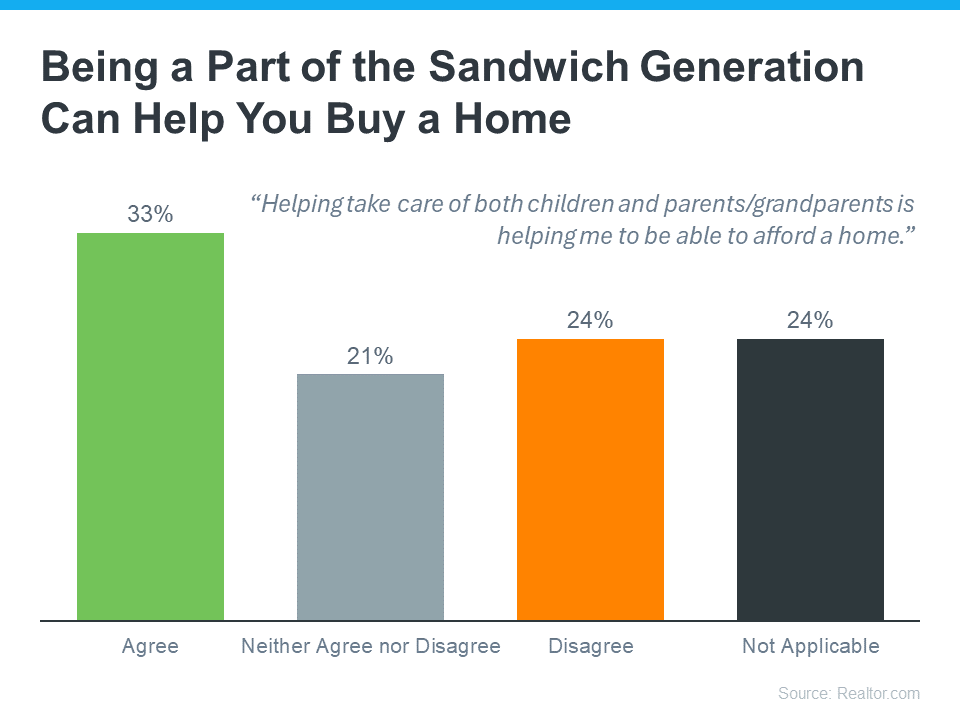

Are you a part of the Sandwich Generation? According to Realtor.com, that is a name for the roughly one in six Americans who take care of their children and their parents or grandparents at the same time.

If that sounds familiar to you, juggling all the responsibilities involved certainly must have its challenges. But it turns out there is one pretty significant benefit: it can actually make it a bit easier for you to buy a home.

Realtor.com asked members of the Sandwich Generation if they agree or disagree that taking care of children and parents at the same time is helping them afford a home. A third of respondents said their situation made it easier to buy (see graph below):

Here are a few ways their caretaking situation might be helping those 33% buy a home:

Here are a few ways their caretaking situation might be helping those 33% buy a home:

Beyond just the financial reasons, buying a multi-generational home has other advantages. The Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) highlights some of the most popular, including:

The Mortgage Reports sums it up this way:

Buying a house with your parents can be a great way to ease caregiving, support young children, or simply bring loved ones closer together. And considering the steep rise in home prices over the last few years, it can make homeownership a lot more affordable.

If you are in the Sandwich Generation and thinking about buying a multi-generational home, working with a local real estate agent is essential. Finding a home that works for so many people can be tricky. An agent will use their expertise to help you find one that meets the needs of, and has enough space for, everyone who is going to live there.

Being a part of the Sandwich Generation comes with its challenges – but it also might come with one truly great perk. If you are looking to buy a home, your caregiving situation can actually make it a bit easier for you to afford a home. To learn more, reach out to a local real estate agent.

For Buyers Buying Tips Thu, 01 Aug 2024 10:30:00 +0000

Looking to buy, sell, or invest in real estate? We're here to make your dreams a reality! Whether it's finding your perfect home, securing a lucrative investment property, or selling your current one, our dedicated team is ready to guide you every step of the way. Reach out to us today to start your journey towards your real estate goals!